Demystifying the Property Tech landscape

The largest asset class

Real Estate is the largest asset class. To get a grasp on just how huge it is: the global equity market capitalization is valued at $70.1 trillion. The global bond market is topping out at $92.2 trillion. Real estate is a whopping $217 trillion — making it the world’s most important asset class.

And as a result real estate has a very wide ecosystem that encompasses many sub-ecosystems. Hence, it is hard to make sense of this sprawling space. This article is my attempt to make sense of this ecosystem.

What is Property Tech?

PropTech, is the term used to describe the broad application of technology to real estate markets. It refers to the myriad tech companies working to transform the real estate industry, based on a rapidly changing digital landscape and ever-shifting consumption trends and patterns.

PropTech often overlaps with FinTech, which refers to financial technology startups that use innovative digital methods to provide financial services.

Property Tech can be divided into two big segments:

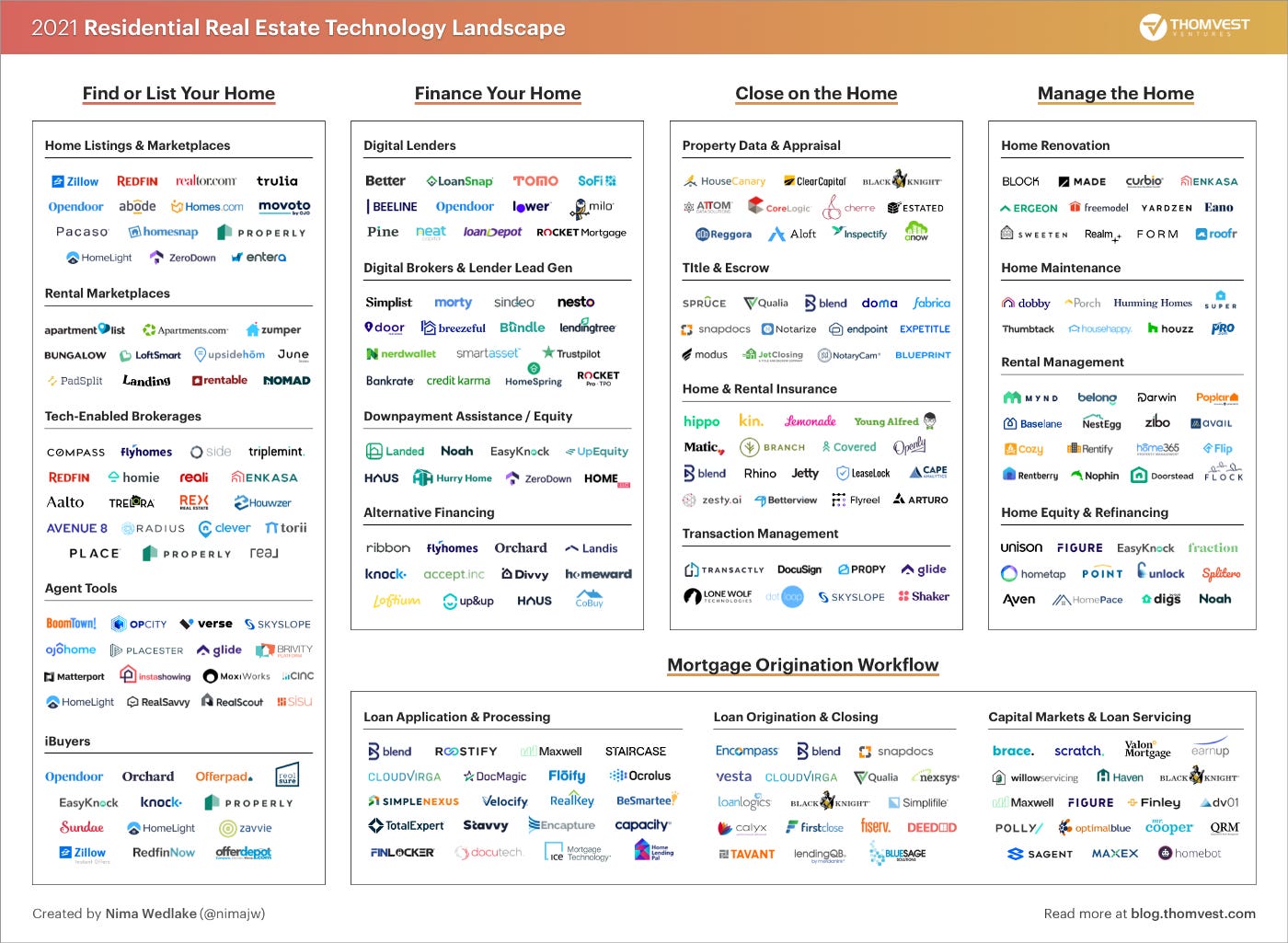

Residential landscape:

Residential real estate consists of places where people live, either owner-occupied or rented to tenants. Common asset types of residential real estate include, single-family homes, townhomes, condominiums etc.

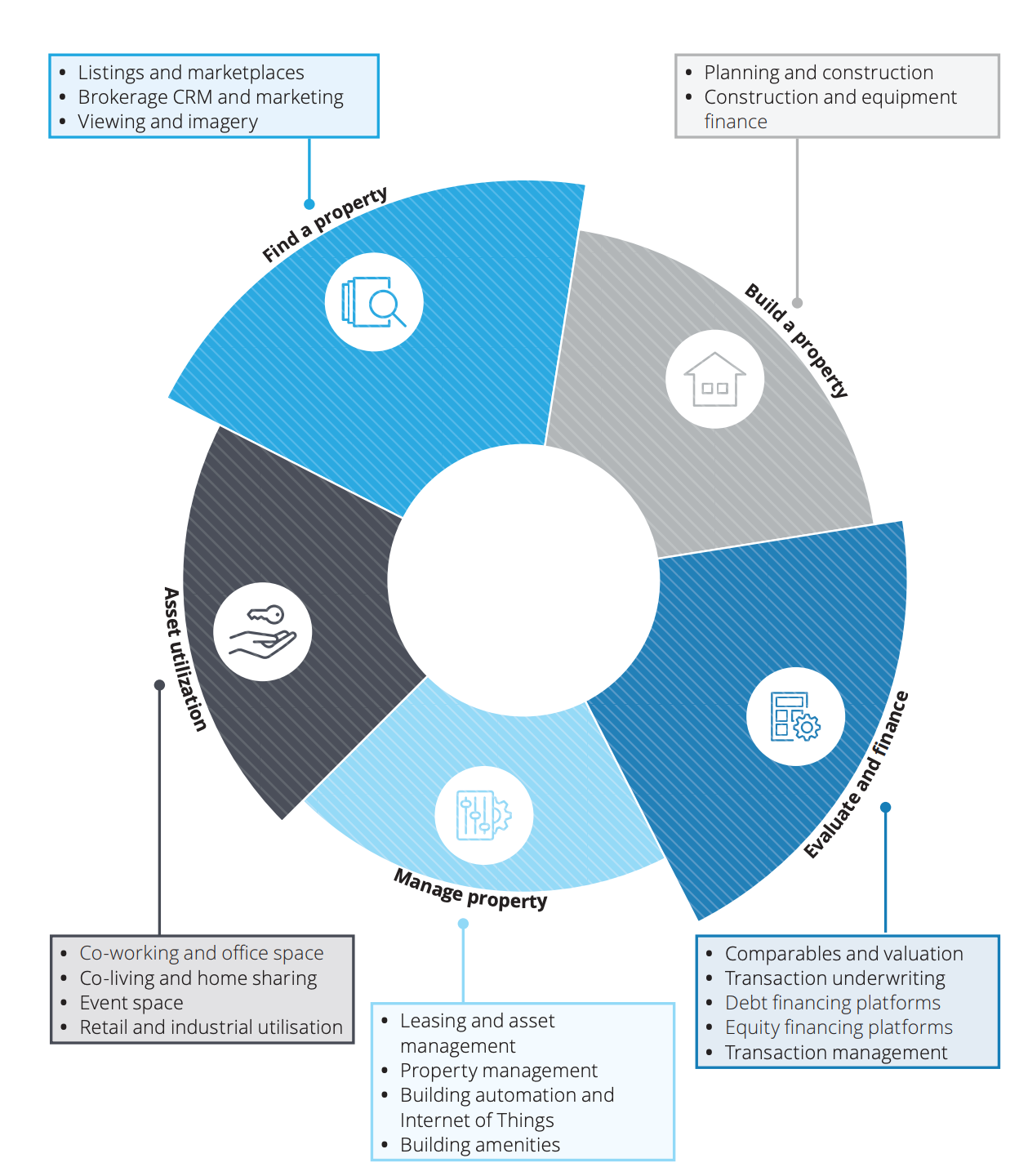

Commercial landscape:

Commercial real estate consists of places where people do business. Property can be owner-occupied, such as a corner fast food outlet or bank branch, or be rented to commercial tenants, such as a multi-tenant shopping center.

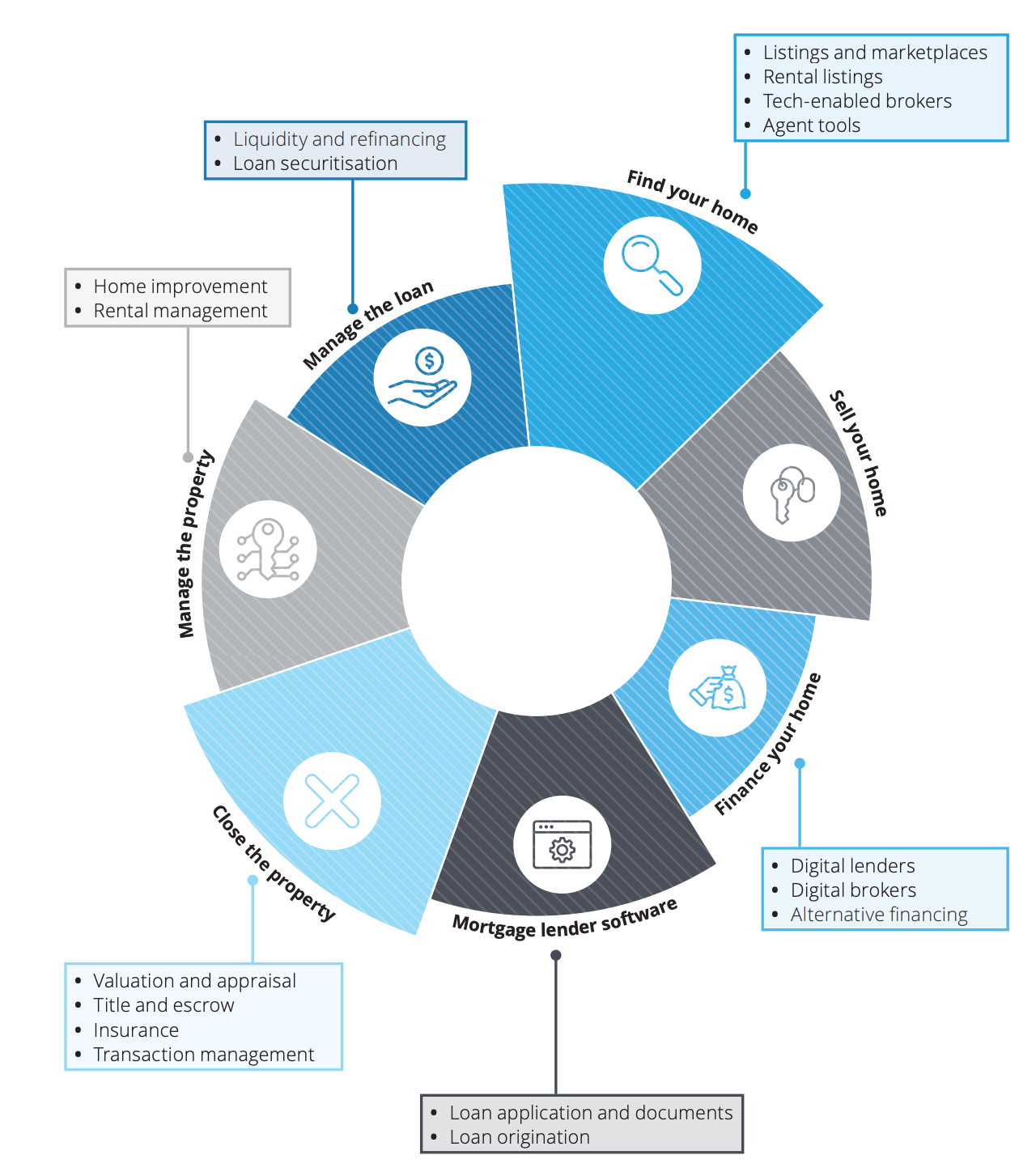

Residential Landscape

Nima Wedlake from Thomvest Ventures came up with defining the proptech landscape for both residential and commercial real estate. Here is their graphic visualization:

Commercial Landscape

However, in Nima’s proptech market map, I found missing the investors players like REITs. I asked him a question on Twitter:

However, I found PropTechZone which had a more exhaustive landscape map that included REITs too.

Alternative Landscape by PropTechZone

Folks from PropTechZone have also done a great job in making sense of the landscape in an altered format.

They break it down to four pillars:

Invest & finance

Plan & Build

Buy, Sell & Rent

Manage & Operate

Invest & Finance

Under invest & finance, we have:

Alternative Financing

Data & Valuation

Debt Crowdfunding

Equity Crowdfunding

Home Insurance

Plan & Build

Advanced Building Methods

Construction Marketplaces

Green Building

On-Site Execution

Planning & Design Tools

Prefab Building

Safety & Training

Smart Buildings

Buy, Sell & Rent

Agent Tools & Services

Commercial Search

Home Search

iBuyer

Other Space Search

Tech-Enabled Brokerage

Title & Escrow

Transaction Management

Travel & Vacation Search

Virtual Tours

Other Space Search

Manage & Operate

Brandboxing

Energy Management

Flexible Workplace & Coworking

Indoor Navigation

Leasing & Asset Management

NextGen Hospitality

NextGen Rentals & Coliving

Property Management

Smart Home

Tenant Experience

I hope you found the maiden post on proptechlessons valuable.

In the future posts, I will demystify each of these building blocks of proptech one after another.